DEI Metrics in Executive Compensation

June 29th marks the one-year anniversary of the landmark Supreme Court decision in Students for Fair Admissions v. Harvard, which eliminated affirmative action in college admissions. Following the Court’s decision, companies’ diversity, equity, and inclusion (DEI) policies and programs that focus on specific underrepresented (racial) groups have resulted in a rise in backlash and reverse discrimination lawsuits (i.e., claims of discrimination against members of a majority rather than minority group).[1] According to data from The Conference Board, 62% of surveyed executives believe the Court’s decision has negatively affected their firm’s diversity efforts, 53% expect scrutiny on corporate diversity efforts to increase over the next three years, and 66% consider the current environment surrounding corporate diversity efforts to be very or extremely challenging.

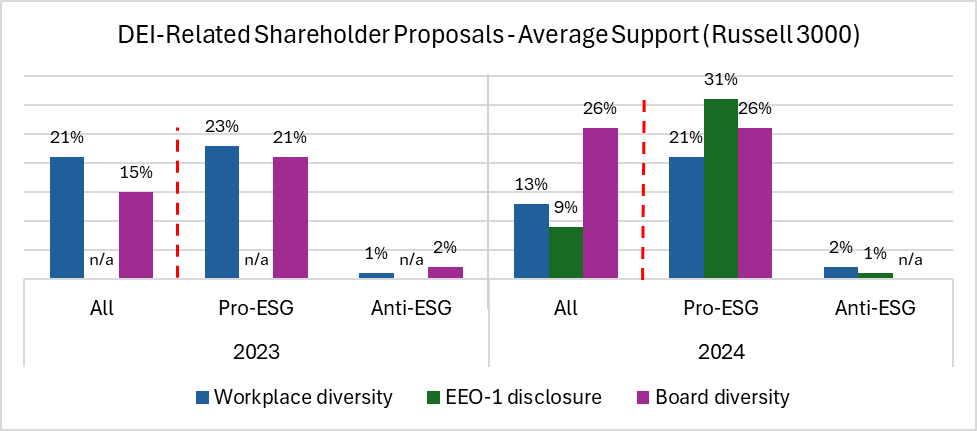

These challenges are also unfolding in the proxy season. As of May 31, 2024, according to data collected for The Conference Board by ESG data analytics firm ESGAUGE, the number of DEI-related shareholder proposals going to a vote in the Russell 3000 have almost doubled compared to the same period in 2023 (from 13 in 2023 to 25 in 2024). And unlike last year, when companies and shareholders were often able to reach a compromise on shareholder proposals relating to topics such as workplace diversity, equal employment opportunity component 1 (EEO-1) data disclosure, and board diversity, most companies receiving a DEI-related proposal have not been able to avoid a vote this year (7 DEI-related proposals have been withdrawn thus far in 2024 versus 20 during the same time in 2023). Moreover, DEI has been a growing focus of conservative shareholders who have ramped up their anti-ESG proposal activity this year.

Source: ESGAUGE / The Conference Board, 2024.

Note: 2023/2024: January through May.

The common thread in the mainstream (i.e., pro-ESG) shareholder proposals on workplace diversity – the most common DEI-related proposal type – is a request for companies to report on the effectiveness and alignment of the company’s DEI efforts. Proposals typically request the company to:

- Evaluate its DEI initiatives using quantitative metrics for workforce diversity, hiring, promotion, and retention, with data broken down by gender, race, and ethnicity; or

- Analyze whether the company’s hiring practices, particularly those related to people with arrest or incarceration records, are aligned with publicly stated diversity commitments and whether they may pose reputational or legal risks due to potential discrimination claims.

Conversely, the common thread in the workplace diversity proposals filed by conservative proponents is a concern about the potential for DEI initiatives leading to reverse discrimination lawsuits. The proposals typically request a report assessing (1) whether the company’s DEI practices may create risks of discriminating against individuals who might sue the company (including employees, suppliers, contractors, and retained professionals) for illegal discrimination on the basis of protected categories such as race and sex, and (2) the potential costs of such discrimination to the business.

However, while the volume of DEI-related shareholder proposals going to a vote has increased in 2024, average support has dropped, from 19% in 2023 to 13% in 2024. This is primarily due to the growing number of proposals filed by conservative proponents, which have received average support of just 1.8%. When excluding such proposals, average support goes up to 22%, which is slightly below the 23% average support in the first five months of 2023. This level is consistent with average support for mainstream environmental and social (E&S) proposals thus far in the proxy season (21% in 2024 versus 22% in 2023).

Source: ESGAUGE / The Conference Board, 2024.

Source: ESGAUGE / The Conference Board, 2024.

Note: 2023/2024: January through May.

Additionally, while one workplace diversity proposal passed in 2023 (at Expeditors International of Washington, Inc.), no DEI-related proposals have received majority support thus far in 2024. Moreover, at several companies that have received workplace diversity proposals for two consecutive years, support has declined in 2024 (e.g., Adobe Inc., Badger Meter, Inc., Berkshire Hathaway Inc., Danaher Corporation, and Eli Lilly and Company).

The value of DEI initiatives. Regardless of receiving a DEI-related shareholder proposal, all companies should consider integrating DEI in their business strategy and operations. Indeed, DEI is a vital catalyst for:

- Enhanced innovation and creativity: Companies with diverse management teams demonstrate 19% higher revenues due to innovation.

- Improved decision making: Diverse teams make better decisions up to 87% of the time, through leveraging varied perspectives to identify opportunities and avoid pitfalls.

- Greater market understanding and reach: Diverse teams are better positioned to serve a broad customer base, with companies demonstrating higher racial and ethnic diversity being 35% more likely to have financial returns above their industry medians.

- Attraction and retention of talent: Diversity is a key motivating factor for many job seekers, with 76% considering it important when evaluating job offers.

- Enhanced employee engagement and performance: Inclusive workplaces are linked with higher engagement and productivity, with highly engaged employees outperforming peers by 147% in earnings per share.

There is also broad public support for corporate DEI efforts. According to a 2022 survey by The Conference Board, improving the diversity and inclusivity of the workforce is a top five issue that US consumers want companies to focus on to improve society.

DEI-related considerations for companies. However, in light of the Supreme Court’s decision in SFA v. Harvard as well as increasing DEI backlash, companies may want to reassess their DEI commitments and public statements, and consider adopting a broader definition of “diversity,” acknowledging that every individual brings a unique set of experiences, perspectives, and skills, not just those from minority groups. This broader view recognizes the importance of diverse backgrounds, including different educational, geographical, and socio-economic contexts, alongside gender, race, ethnicity, disability, and other attributes. Additionally, companies should be mindful of the following:

- Steer clear of stereotypes and quotas. Avoid classifications that could be viewed as racial stereotypes and numerical representation targets based on race or ethnicity.

- Communicate with care. The Court’s decision is full of citations to internal e-mails that made clear that race was a primary factor in certain admission decisions. To the extent that anyone suggests race was the key factor in a hiring decision or board appointment, those communications will be difficult to explain in litigation.

- Focus on equal opportunity. Programs designed to provide equal opportunity are more likely to withstand challenges under the 14th Amendment, which guarantees equal protection and other rights all persons. Initiatives such as the “Rooney Rule” – a practice of interviewing minority candidates for top jobs – and training and development designed to provide equal opportunity are still within the bounds of the law.

- Think about how to measure impact. A key part of any court’s analysis of any DEI initiative will be whether it advances legitimate goals. So being able to articulate how the company’s DEI programs serve the company’s business goals – and being able to produce data that support that explanation – will be critically important. In this respect, the challenge for DEI and ESG are the same in the face of backlash: it’s vital to make a fact-based business case for the company’s initiatives.

Endnotes

1 For example, America First Legal alleges that corporate DEI programs are illegal under Title VII of the 1964 Civil Rights Act and filed dozens of complaints with the US Equal Employment Opportunity Commission against companies. In May of 2024, Florida’s Attorney General called on the Florida Commission on Human Relations to investigate Starbucks Coffee Company for hiring practices that appear to discriminate on the basis of race. In March of 2024, a federal judge in Texas ruled that the Minority Business Development Agency had violated the Equal Protection Clause of the Constitution by presuming that members of certain minority groups are “socially or economically disadvantaged” and thus entitled to services. Additionally, in a joint open letter, Attorneys General from 13 states cautioned Fortune 100 CEOs about “serious legal consequences“ linked to race-based employment practices and diversity policies. (go back)

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.