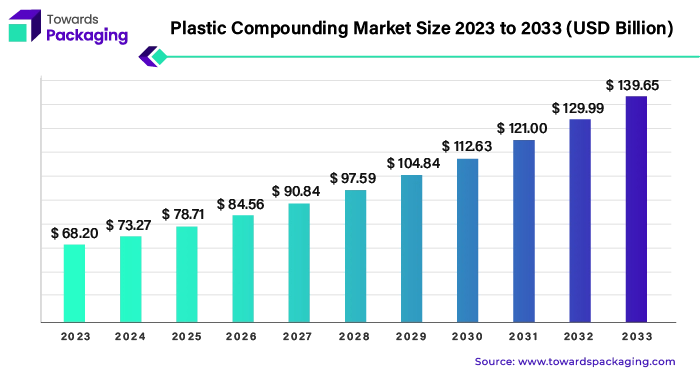

Plastic Compounding Market Size Expected to Reach USD 139.65 Bn by 2033

The global plastic compounding market size is calculated at USD 73.27 billion in 2024 and is expected to reach around USD 139.65 billion by 2033, growing at a CAGR of 7.43% from 2024 to 2033.

/EIN News/ -- Ottawa, Aug. 20, 2024 (GLOBE NEWSWIRE) -- The global plastic compounding market size was valued at USD 68.20 billion in 2023 and is predicted to hit around USD 129.99 billion by 2032, a study published by Towards Packaging a sister firm of Precedence Statistics.

Get a comprehensive Plastic Compounding Market Size, Companies, Share free sample: https://www.towardspackaging.com/personalized-scope/5199

Key Takeaways

- Asia Pacific dominated the plastic compounding market with the largest revenue share of 45% in 2023.

- By source, the fossil-based segment held the largest revenue share 57% in 2023.

- By source, the recycled segment is expected to be the fastest-growing during the forecast period.

- By product, the polypropylene (PP) segment has generated more than 31% of revenue share in 2023.

- By product, the polyethylene (PE) segment is estimated to be the fastest-growing during the forecast period.

- By application, the automotive segment accounted for the biggest revenue share of 26% in 2023.

- By application, the packaging segment is estimated to be the fastest-growing during the forecast period.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

How Does the Plastic Industry Grows Across the Globe?

The plastic compounding market is utilized in transforming the original properties of basic compounds and turning them into specialised materials which meet the requirements of different end-users. Along with these qualities, enhancing the plastic compound’s heat resistance and electrical conductivity are the leading objectives of the market.

The required safety precautions, the need for flexible packaging and cost-effective availability of material has increased the demand for plastic compound. The utilization of plastic compounds for a wide range of applications increases the demand of the plastic compounding market. Along with customization of specific requirements, improvisation of properties like strength and durability increase the growth rate of the plastic compounding market.

Driver

Lightweight Materials and Supporting Policies: A Plastic Drive

The major diving factor are the lightweight materials utilized in plastic compounding which are efficient in automative, given the reason that it reduces emissions and prioritizes safety regulations. The lightweight plastic compounds are also used in different industries like construction, packaging and electronics wherein its barrier properties, weather-resistant features and electrical conductivity are also the major driving factors and industries that contribute to the plastic compounding market.

The government policies which support the safety manufacturing guidelines and also promote them also drive the market. The policies also impact market growth.

Get a customized Plastic Compounding Market report designed according to your preferences: https://www.towardspackaging.com/customization/5199

Restraint

Environmental Concern: A Challenge to the Plastic Market

The leading challenge which hinders the growth of the plastic compounding market is environmental concern. The increasing awareness among the public about the harmful side effects and the increasing pressure on companies due to strict regulations are a major hinderance.

Apart from this, production, utilization and disposal of the plastic compounds can cause challenges for the key players and competition from alternatives like biodegradable and sustainable materials are posing threat to the plastic compounding market. Furthermore, the rise in prices due to economic ups and downs can lead to decrease of the market rate.

Technology and AI: Improvisation of the Plastic Compounding Market

When natural resources are combined with plastic, formation of compounded plastic takes place. As a result, to obtain more sustainable and cost-effective options, technology is used to check the compatibility between compounded resources.

AI integration can create new plastic reins by mixing and altering the polymer base. Technological advancement will enhance the properties of plastic like colour, flexibility, heat and weather resistance. Furthermore, it will also improve the electrical conductivity and this will change the protection probability of the product.

The integration of AI has improved the market by researching and developing new barrier designs, so that it can develop more sustainable solutions and can create more durable packaging. In addition, technological advancements have made it easy to analyse the demand of supply chain, detect error in the produced material and give detailed report on environmental stressors which will check the durability of the product. The remarkable innovation in AI technologies will provide multiple opportunities to the leading market players to expand the plastic compounding market.

Opportunity

Advantages: Requirement of Key Players and Less Energy Usage

Plastic is an invincible material for the market key players due to its durability, lightweight and flexibility in colour, shape and size. Less use of energy resources compared to glass, paper and metal and dependence of renewable energies on plastic increases the demand of the plastics compounds and creates opportunities for the market.

The use of plastic material decreases the packaging weight and also saves energy costs by reducing waste material which also leads to advantages of bio-degradable compounds. Different industries like food and beverages, pharmaceutical and chemical increase the plastic opportunity due to its distribution costs, especially the industrial sector due to durable plastic pipes preventing the water leakage.

Asia’s Dominance and Projection with Consumer Demand

Asia-Pacific dominated the plastic compounding market in 2023. The growing middle class, investments in infrastructure and steady industrialisation drive the market growth. The rising urbanization and a focus on the sustainable solutions is the goal of the region. Countries like India and China are the leading contributors in the plastic compounding market.

In October 2023, Coca-Cola had announced launch of red bottles in 250 ml and 750 ml which are approved by the US FDA and European Food Safety Authority (EFSA) for food-grade recycled material and also crafted from 100% food-grade recycled polyethylene terephthalate (PET). The bottles were manufactured by the company’s bottling partners who were Moon Beverages Ltd., and SLMG Beverages Ltd.

North America's Position & Technological Advancements

North America is observed to grow at the fastest rate during the forecast period. The market in this region is driven by technological advancements, demand of plastic in packaging and construction sector with a focus on sustainability. Countries like United States and Canada are leading contributors in the plastic compounding market.

In May 2024, Premix Oy, a Finnish compounder, opened a new official plant which produced electrically conductive (EC) plastic compounds and masterbatches. The company also stated that the electrically conductive polymers plant will produce 45 million pounds per year of polyethylene and polypropylene black masterbatches.

North America has established itself as the mature market with its focus on sustainability and recycling practices. The demand for renewable energy sources and new development in lightweight materials for growing automative sector are the driving factors of the market.

In March 2024, Repsol launched a new lubricant which was a part of its recycled range of sustainable polyolefins has incorporated 60% recycled post-consumer plastic. It was available in five colours and was able to reduce carbon footprint by 25%. The company stated that it will aim to reduce 30% of carbon footprint and produce 10% of its polyolefins as biobased and circular products by 2030.

Recent Developments

Nylon Corporation of America (NYCOA), Company: Nylon Corporation of America (NYCOA), Headquarters: Paterson, USA

- In April 2024, NYCOA announced the introduction of NXTamid, a long-chain polyimide designed to replace PA11 and PA12. NXTamid is a new, plasticizer-free, and sustainable material that offers lower moisture absorption and improved dimensional stability compared to its predecessors.

Asahi Kasei, Company: Asahi Kasei, Headquarters: Tokyo, Japan

- In April 2024, Asahi Kasei participated in NPE 2024, the largest plastic industry trade show, where the company showcased new technologies including 3D printing filaments and purging compounds. Additionally, Asahi Kasei emphasized its commitment to meeting customer requirements comprehensively, eliminating the need for clients to engage with multiple vendors.

Segmental Insights

By Source

Fossil-based is the dominating segment in the plastic compounding market. It is the dominating source due to its properties which are low cost and abundant resources. It is demand due less carbon emission and less usage of energy resources during manufacturing process, and also due to its sustainable disposal process. In addition, its recycling feature makes it the dominating segment among the market players.

The fastest growing segment is the bio-based source due to its use of carbon-neutral energy for production. The advantage of being compatible with existing recycled materials and being developed into new compounds by upgraded biological procedures is increasing the demand of the segment among the consumers. Its recycling property gives it a circular economy and cost-effective status.

By Product

There are various products used in the plastic compounding market based on their compatibility and application. Among them, polyethylene segment dominate the plastic compounding market. The product is known for its durability and is used in packaging and construction sector. The polypropylene segment is the fastest growing segment in the plastic market due to its cost-effectiveness and usage in wide range of industries. Other products like thermoplastic vulcanizates, thermoplastic polyolefins, polyamide and acrylonitrile butadiene styrene are used in compounding process.

More Insights of Towards Packaging

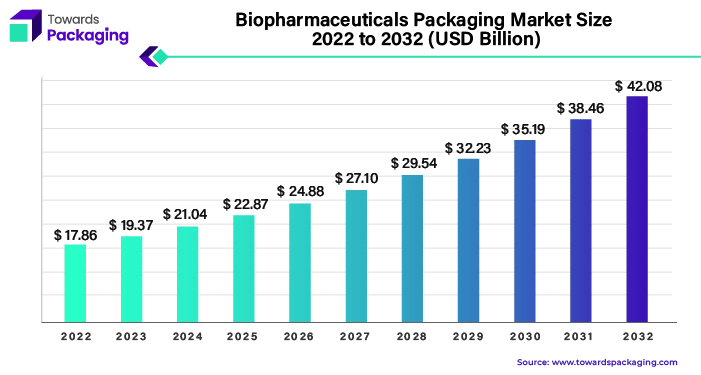

Biopharmaceuticals Packaging Market Size and Growth (2023 - 2032)

The global biopharmaceuticals packaging market size forecasted to expand from USD 17.86 billion in 2022 to attain a calculated USD 42.08 billion by 2032, extending at a 9.0% CAGR between 2023 and 2032.

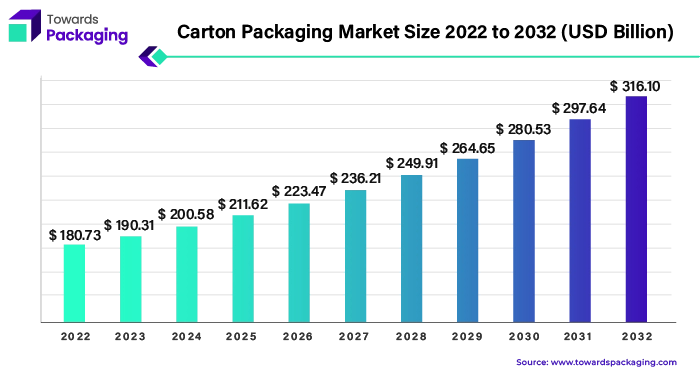

Carton Packaging Market Size, Share, Growth and Future Analysis (2023 - 2032)

The global carton packaging market size is estimated to grow from USD 180.73 billion in 2022 to reach an estimated USD 316.10 billion by 2032, growing at a 5.8% CAGR between 2023 and 2032.

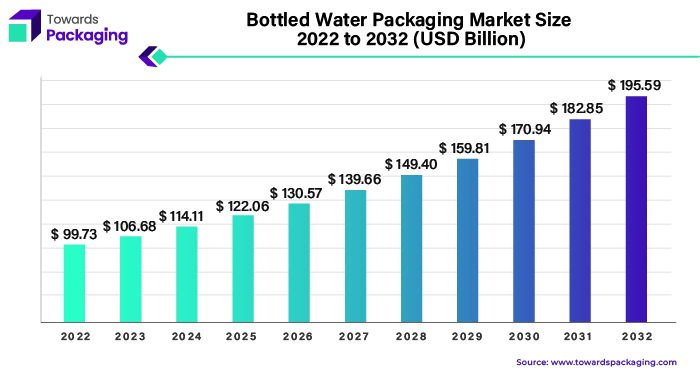

Bottled Water Packaging Market Size and Growth (2023 - 2032)

The global bottled water packaging market size was at USD 99.73 billion in 2022 to secure an estimated USD 195.59 billion by 2032, stretching at a 6.9% CAGR between 2023 and 2032.

- The global industrial packaging market size forecasted to expand from USD 62.56 billion in 2022 to achieve an approximation USD 101.42 billion by 2032, increasing at a 5.0% CAGR between 2023 and 2032.

- The global electronic packaging market size calculated to go up from USD 1.40 billion in 2022 to realize an expected USD 6.14 billion by 2032, developing at a 16.0% CAGR between 2023 and 2032.

- The global foam packaging market size presumed to grow from USD 17.40 billion in 2022 to fulfill a guesstimated USD 29.28 billion by 2032, thriving at a 5.35% CAGR between 2023 and 2032.

- The global medical device packaging market size speculated to escalate from USD 24.87 billion in 2022 to reach a conjectured USD 52.67 billion by 2032, advancing at a 7.42% CAGR between 2023 and 2032.

- The global virgin plastic packaging market size envisaged to surge from USD 117.23 billion in 2022 to acquire an anticipated USD 322.50 billion by 2032, maturing at a 9.91% CAGR between 2023 and 2032.

- The global aseptic packaging market size to elevate from USD 50.34 billion in 2022 to reach an estimated secure a forecasted USD 138.48 billion by 2032, escalating at a 10.7% CAGR between 2023 and 2032.

- The global rigid packaging market size expected to increase from USD 209.48 billion in 2022 hit a presumed USD 333.17 billion by 2032, augmenting at a 4.8% CAGR between 2023 and 2032.

Plastic Compounding Market TOC

Executive Summary

- Market Overview

- Key Findings

- Market Trends

- Market Dynamics

Introduction

- Market Definition

- Research Methodology

- Assumptions and Limitations

Market Dynamics

-

Drivers

- Increasing Demand in Automotive Industry

- Rising Adoption in Packaging Applications

- Growth in Electrical and Electronics Sector

-

Restraints

- Volatility in Raw Material Prices

- Environmental Concerns

-

Opportunities

- Advancements in Bio-based Plastics

- Expanding Applications in Medical Devices

-

Challenges

- Regulatory Hurdles

- Technological Barriers

Market Segmentation by Source

- Fossil-based

- Overview

- Market Size and Forecast

- Key Trends

- Bio-based

- Overview

- Market Size and Forecast

- Key Trends

- Recycled

- Overview

- Market Size and Forecast

- Key Trends

Market Segmentation by Product

- Polyethylene (PE)

- Overview

- Market Size and Forecast

- Key Applications

- Polypropylene (PP)

- Overview

- Market Size and Forecast

- Key Applications

- Thermoplastic Vulcanizates (TPV)

- Overview

- Market Size and Forecast

- Key Applications

- Thermoplastic Polyolefins (TPO)

- Overview

- Market Size and Forecast

- Key Applications

- Polyvinyl Chloride (PVC)

- Overview

- Market Size and Forecast

- Key Applications

- Polystyrene (PS)

- Overview

- Market Size and Forecast

- Key Applications

- Polyethylene Terephthalate (PET)

- Overview

- Market Size and Forecast

- Key Applications

- Polybutylene Terephthalate (PBT)

- Overview

- Market Size and Forecast

- Key Applications

- Polyamide (PA)

- Overview

- Market Size and Forecast

- Key Applications

- Polycarbonate (PC)

- Overview

- Market Size and Forecast

- Key Applications

- Polyurethane (PU)

- Overview

- Market Size and Forecast

- Key Applications

- Polymethyl Methacrylate (PMMA)

- Overview

- Market Size and Forecast

- Key Applications

- Acrylonitrile Butadiene Styrene (ABS)

- Overview

- Market Size and Forecast

- Key Applications

- Others

- Overview

- Market Size and Forecast

- Key Applications

Market Segmentation by Application

- Automotive

- Overview

- Market Size and Forecast

- Key Trends

- Building and Construction

- Overview

- Market Size and Forecast

- Key Trends

- Electrical and Electronics

- Overview

- Market Size and Forecast

- Key Trends

- Packaging

- Overview

- Market Size and Forecast

- Key Trends

- Consumer Goods

- Overview

- Market Size and Forecast

- Key Trends

- Industrial Machinery

- Overview

- Market Size and Forecast

- Key Trends

- Medical Devices

- Overview

- Market Size and Forecast

- Key Trends

- Optical Media

- Overview

- Market Size and Forecast

- Key Trends

- Aerospace and Defense

- Overview

- Market Size and Forecast

- Key Trends

- Others

- Overview

- Market Size and Forecast

- Key Trends

Regional Analysis

- North America

- Market Overview

- Market Size and Forecast

- Key Trends

- Europe

- Market Overview

- Market Size and Forecast

- Key Trends

- Asia Pacific

- Market Overview

- Market Size and Forecast

- Key Trends

- Latin America

- Market Overview

- Market Size and Forecast

- Key Trends

- Middle East and Africa

- Market Overview

- Market Size and Forecast

- Key Trends

Cross-Sectional Analysis

Introduction

- Overview of Cross-Sectional Analysis

- Purpose and Scope

Cross-Segmental Analysis by Source and Product

-

Fossil-based Plastics

- Polyethylene: Market demand, trends, and challenges.

- Polypropylene: Market dynamics and application trends.

- Thermoplastic Vulcanizates: Use in high-performance applications.

- Thermoplastic Polyolefins: Competitive analysis and market value.

- Polyvinyl Chloride: Stability and regulatory impacts.

- Polystyrene: Environmental impact and market trends.

- Polyethylene Terephthalate: Recycling trends and applications.

- Polybutylene Terephthalate: Niche applications and market value.

- Polyamide: Performance characteristics and demand.

- Polycarbonate: Market growth and competition.

- Polyurethane: Versatility and applications.

- Polymethyl Methacrylate: Use in optical and signage.

- Acrylonitrile Butadiene Styrene: Demand in consumer goods and electronics.

- Others: Overview of emerging and niche products.

-

Bio-based Plastics

- Polyethylene: Growth trends and applications.

- Polypropylene: Adoption rates and market drivers.

- Thermoplastic Vulcanizates: Performance and cost considerations.

- Thermoplastic Polyolefins: Sustainability and market adoption.

- Polyvinyl Chloride: Regulatory pressures and sustainable alternatives.

- Polystyrene: Transition challenges and opportunities.

- Polyethylene Terephthalate: Recycling and bio-based options.

- Polybutylene Terephthalate: Specialty applications and growth.

- Polyamide: Bio-based innovations and market value.

- Polycarbonate: Environmental benefits and market potential.

- Polyurethane: Adoption in sustainable applications.

- Polymethyl Methacrylate: Growth in sustainable products.

- Acrylonitrile Butadiene Styrene: Trends in bio-based alternatives.

- Others: Emerging bio-based products and technologies.

-

Recycled Plastics

- Polyethylene: Impact on the market and recycling efficiency.

- Polypropylene: Recycling trends and economic implications.

- Thermoplastic Vulcanizates: Recycled content integration.

- Thermoplastic Polyolefins: Adoption in recycling programs.

- Polyvinyl Chloride: Challenges and opportunities in recycling.

- Polystyrene: Recycled content and market dynamics.

- Polyethylene Terephthalate: Innovations in recycling and sustainability.

- Polybutylene Terephthalate: Recycled materials and performance.

- Polyamide: Market impact of recycled content.

- Polycarbonate: Recycled materials and application trends.

- Polyurethane: Recycling processes and market impact.

- Polymethyl Methacrylate: Recycled applications and market value.

- Acrylonitrile Butadiene Styrene: Recycling challenges and solutions.

-

Others: Overview of recycled products and market trends.

Cross-Segmental Analysis by Source and Application

-

Fossil-based Plastics

- Automotive: Demand and material preferences.

- Building and Construction: Applications and market dynamics.

- Electrical and Electronics: Performance and regulatory impacts.

- Packaging: Market trends and sustainability.

- Consumer Goods: Market size and growth drivers.

- Industrial Machinery: Application trends and material preferences.

- Medical Devices: Regulatory considerations and market value.

- Optical Media: Market demand and technological advancements.

- Aerospace and Defense: Performance and material requirements.

- Others: Overview of applications and market influence.

-

Bio-based Plastics

- Automotive: Adoption rates and benefits.

- Building and Construction: Use in sustainable building materials.

- Electrical and Electronics: Market growth and material characteristics.

- Packaging: Sustainability and market trends.

- Consumer Goods: Adoption in various products.

- Industrial Machinery: Market size and application trends.

- Medical Devices: Compliance and material performance.

- Optical Media: Emerging applications and market potential.

- Aerospace and Defense: Use in high-performance applications.

- Others: Emerging applications and market impact.

-

Recycled Plastics

- Automotive: Recycling trends and application benefits.

- Building and Construction: Use of recycled materials and market growth.

- Electrical and Electronics: Impact of recycling on market dynamics.

- Packaging: Recycled content trends and consumer preferences.

- Consumer Goods: Adoption and market implications.

- Industrial Machinery: Integration of recycled materials.

- Medical Devices: Challenges and regulatory impacts.

- Optical Media: Recycled materials and market applications.

- Aerospace and Defense: Use of recycled materials in specialized applications.

-

Others: Overview of recycled plastic applications and market trends.

Cross-Segmental Analysis by Product and Region

-

Polyethylene

- North America: Market trends and applications.

- Europe: Adoption and regulatory influences.

- Asia Pacific: Growth drivers and market dynamics.

- Latin America: Market size and potential.

- MEA: Regional demand and challenges.

-

Polypropylene

- North America: Demand and application trends.

- Europe: Market growth and regulatory impacts.

- Asia Pacific: Adoption rates and competitive landscape.

- Latin America: Market potential and growth factors.

- MEA: Regional trends and market opportunities.

-

Thermoplastic Vulcanizates

- North America: Market applications and growth trends.

- Europe: Adoption in high-performance sectors.

- Asia Pacific: Market dynamics and technological advancements.

- Latin America: Growth drivers and challenges.

- MEA: Application trends and market size.

-

Thermoplastic Polyolefins

- North America: Demand and application areas.

- Europe: Market growth and adoption trends.

- Asia Pacific: Competitive landscape and market potential.

- Latin America: Market drivers and trends.

- MEA: Regional demand and growth opportunities.

-

Polyvinyl Chloride

- North America: Market size and regulatory impacts.

- Europe: Adoption trends and market dynamics.

- Asia Pacific: Growth factors and market potential.

- Latin America: Application trends and market challenges.

- MEA: Demand and market growth.

-

Polystyrene

- North America: Market applications and demand trends.

- Europe: Regulatory influences and market growth.

- Asia Pacific: Adoption rates and market dynamics.

- Latin America: Market size and potential.

- MEA: Regional trends and market challenges.

-

Polyethylene Terephthalate

- North America: Recycling trends and market applications.

- Europe: Sustainability and market growth.

- Asia Pacific: Market dynamics and adoption trends.

- Latin America: Growth drivers and market size.

- MEA: Demand and recycling trends.

-

Polybutylene Terephthalate

- North America: Niche applications and market value.

- Europe: Market growth and adoption trends.

- Asia Pacific: Technological advancements and demand.

- Latin America: Market potential and challenges.

- MEA: Regional growth and application trends.

-

Polyamide

- North America: Performance and market trends.

- Europe: Adoption in high-performance applications.

- Asia Pacific: Growth drivers and competitive landscape.

- Latin America: Market size and potential.

- MEA: Demand and market challenges.

-

Polycarbonate

- North America: Market growth and applications.

- Europe: Adoption trends and market dynamics.

- Asia Pacific: Demand and technological advancements.

- Latin America: Market potential and growth factors.

- MEA: Regional demand and market opportunities.

-

Polyurethane

- North America: Versatility and market applications.

- Europe: Growth trends and market dynamics.

- Asia Pacific: Adoption rates and market potential.

- Latin America: Demand and challenges.

- MEA: Market growth and regional trends.

-

Polymethyl Methacrylate

- North America: Optical media applications and market size.

- Europe: Market trends and growth drivers.

- Asia Pacific: Demand and technological advancements.

- Latin America: Market potential and challenges.

- MEA: Regional demand and market growth.

-

Acrylonitrile Butadiene Styrene

- North America: Demand in consumer goods and electronics.

- Europe: Market growth and application trends.

- Asia Pacific: Adoption rates and market dynamics.

- Latin America: Market size and potential.

- MEA: Regional trends and market challenges.

-

Others

- North America: Emerging products and market trends.

- Europe: Niche applications and growth factors.

- Asia Pacific: Adoption and market potential.

- Latin America: Market size and opportunities.

- MEA: Regional growth and product innovations.

Competitive Landscape

- Market Share Analysis

- Key Players

- Company Profiles

- Business Overview

- Product Portfolio

- Financial Performance

- Recent Developments

- Company Profiles

- Competitive Strategies

Go-to-Market Strategies

- Market Entry Strategies

- Market Analysis

- Regulatory Considerations

- Distribution Strategies

- Direct vs. Indirect Sales

- Distribution Channel Analysis

- Marketing and Branding

- Target Audience Identification

- Branding Strategies

- Marketing Campaigns

- Partnership and Collaboration

- Strategic Alliances

- Joint Ventures

- Pricing Strategies

- Pricing Models

- Competitive Pricing Analysis

Integration of AI in the Plastic Compounding Market

- Overview of AI in Manufacturing

- Definition and Scope

- Historical Context

- AI Applications in Plastic Compounding

- Process Optimization

- Quality Control

- Predictive Maintenance

- Supply Chain Management

- Benefits of AI Integration

- Efficiency Improvement

- Cost Reduction

- Enhanced Product Quality

- Challenges and Limitations

- Data Management

- Skill Requirements

- Integration Costs

- Case Studies

- Successful AI Implementations

- Lessons Learned

- Future Trends and Opportunities

- Emerging AI Technologies

- Potential Impact on Market Dynamics

Production and Consumption Data in the Plastic Compounding Market

Production Data

Overview of Production Trends

- Global Production Capacity: Analysis of global production capabilities, including leading manufacturers and their respective capacities.

- Regional Production: Breakdown of production by key regions such as North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

-

Production Technologies: Overview of technologies used in production, including extrusion, injection molding, and blow molding.

Production Volume and Growth

- Historical Production Volumes: Data on historical production volumes over the past 5-10 years.

- Current Production Capacity: Up-to-date statistics on current production capacities of major players in the market.

-

Projected Production Growth: Forecasted production volumes and growth rates for the next 5-10 years.

Key Producers

- Major Manufacturers: Profiles of leading producers, including their production capacities, technologies, and market share.

- Regional Production Leaders: Identification of key producers in different regions and their contribution to global production.

Challenges in Production

- Raw Material Supply: Issues related to the supply of raw materials, including fluctuations in prices and availability.

- Technological Advancements: Impact of technological changes on production efficiency and capacity.

-

Regulatory Compliance: Compliance with environmental and safety regulations affecting production processes.

Consumption Data

Overview of Consumption Trends

- Global Consumption Patterns: Analysis of global consumption trends, including demand across different regions and industries.

- Regional Consumption: Breakdown of consumption by key regions, highlighting major consuming countries and areas of high demand.

-

Sectoral Demand: Overview of demand across various applications, such as automotive, packaging, consumer goods, and medical devices.

Consumption Volume and Growth

- Historical Consumption Volumes: Data on historical consumption volumes over the past 5-10 years.

- Current Consumption Trends: Up-to-date statistics on current consumption patterns and key drivers of demand.

-

Projected Consumption Growth: Forecasted consumption volumes and growth rates for the next 5-10 years.

Key Consumers

- Major Consumers: Profiles of leading consumers by industry, including their consumption patterns and requirements.

- Regional Demand Leaders: Identification of key consuming regions and their contribution to global consumption.

Trends Influencing Consumption

- Technological Innovations: Impact of new technologies on consumption patterns and demand for specific products.

- Economic Factors: Influence of economic conditions on consumption, including growth rates and market dynamics.

-

Consumer Preferences: Shifts in consumer preferences towards sustainable and bio-based plastics, and their impact on consumption.

Challenges in Consumption

- Market Fluctuations: Impact of economic and market fluctuations on consumption patterns.

- Sustainability Concerns: Increasing demand for eco-friendly and sustainable products affecting consumption trends.

-

Regulatory Changes: Impact of regulations on consumption, including restrictions on certain materials and products.

Supply Chain Intelligence/Streamline Operations in the Plastic Compounding Market

Overview

- Importance of Supply Chain Intelligence

- Key Benefits

Importance of Supply Chain Intelligence

- Definition and Scope

- Benefits of SCI

Key Components of Supply Chain Intelligence

- Data Integration

- Centralized Data Systems

- Data Accuracy and Quality

- Advanced Analytics

- Predictive Analytics

- Prescriptive Analytics

- Real-Time Monitoring

- IoT and Sensors

- Dashboard and Reporting

- Artificial Intelligence and Machine Learning

- Demand Forecasting

- Anomaly Detection

Streamlining Operations

- Process Optimization

- Lean Manufacturing

- Six Sigma

- Supply Chain Network Design

- Network Optimization

- Supplier Collaboration

- Inventory Management

- Just-In-Time (JIT)

- Safety Stock

- Logistics and Distribution

- Transportation Management

- Warehouse Management

Challenges in Implementing Supply Chain Intelligence

- Data Management

- Data Silos

- Data Security

- Technology Adoption

- Integration with Existing Systems

- Cost of Implementation

- Skills and Training

- Workforce Skills

- Change Management

Future Trends and Opportunities

- Increased AI Integration

- AI-Driven Insights

- AI-Powered Optimization

- Blockchain Technology

- Transparency and Traceability

- Smart Contracts

- Sustainability Initiatives

- Eco-Friendly Practices

- Circular Economy

- Collaborative Platforms

- Digital Ecosystems

- Data Sharing and Collaboration

Market Outlook and Forecast

- Market Size and Growth Projections

- Future Trends and Opportunities

Appendix

- List of Abbreviations

- References

- Research Methodology

- Contact Information

Act Now and Get Your Plastic Compounding Market Size, Companies and Insight 2033 @ https://www.towardspackaging.com/price/5199

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

Distribution channels: Business & Economy ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release